Duty and excise relates to Import Costing duties and excises on goods received into stock from overseas suppliers. You use the GL Duty and Excise screen to setup your GL interface (integration table) for MDS transactions involving duty and excise so that financial data is transferred automatically to the correct accounts in MGL.

To setup your GL interface for transactions involving duty and excise:

Refer to "Adding a New GL Interface Record" or "Updating a GL Interface Record".

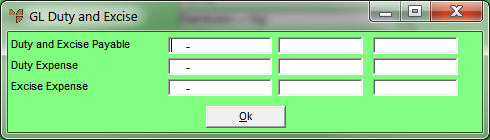

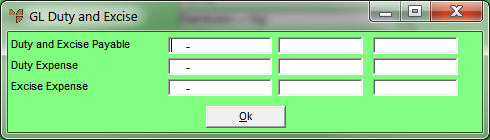

Micronet displays the GL Duty and Excise screen.

|

|

Field |

Value |

|---|---|---|

|

|

Duty and Excise Payable |

Depending on the way your business values its stock, you can enter either the Stock On Hand asset account or an expense account. This account posts a debit (increasing assets or increasing expenses) to the Current Assets (Stock) section or the Cost of Sales (Expense) section of the Profit & Loss. |

|

|

|

Technical Tip The two fields next to each field on this screen are for entry of T1 and T2 accounts. If your company uses T accounts to flag transactions for GL reporting, enter the default T1 account for the GL account in the first field and the default T2 account for the GL account in the second field. You can also press spacebar then Enter to select these T accounts. For more information about T accounts, see "T Accounts". |

|

|

Duty Expense |

|

|

|

Excise Expense |

|

Micronet redisplays the Change GL Interface screen.